Global sales tax solved.

We automate global sales tax compliance, saving finance teams time and money.

Request Demo

WHY TAXWIRE?

Built to protect you from risk

Hundreds of big and small tasks go into getting and staying compliant. From understanding tax exposure to automating filings and government mail. We do them all.

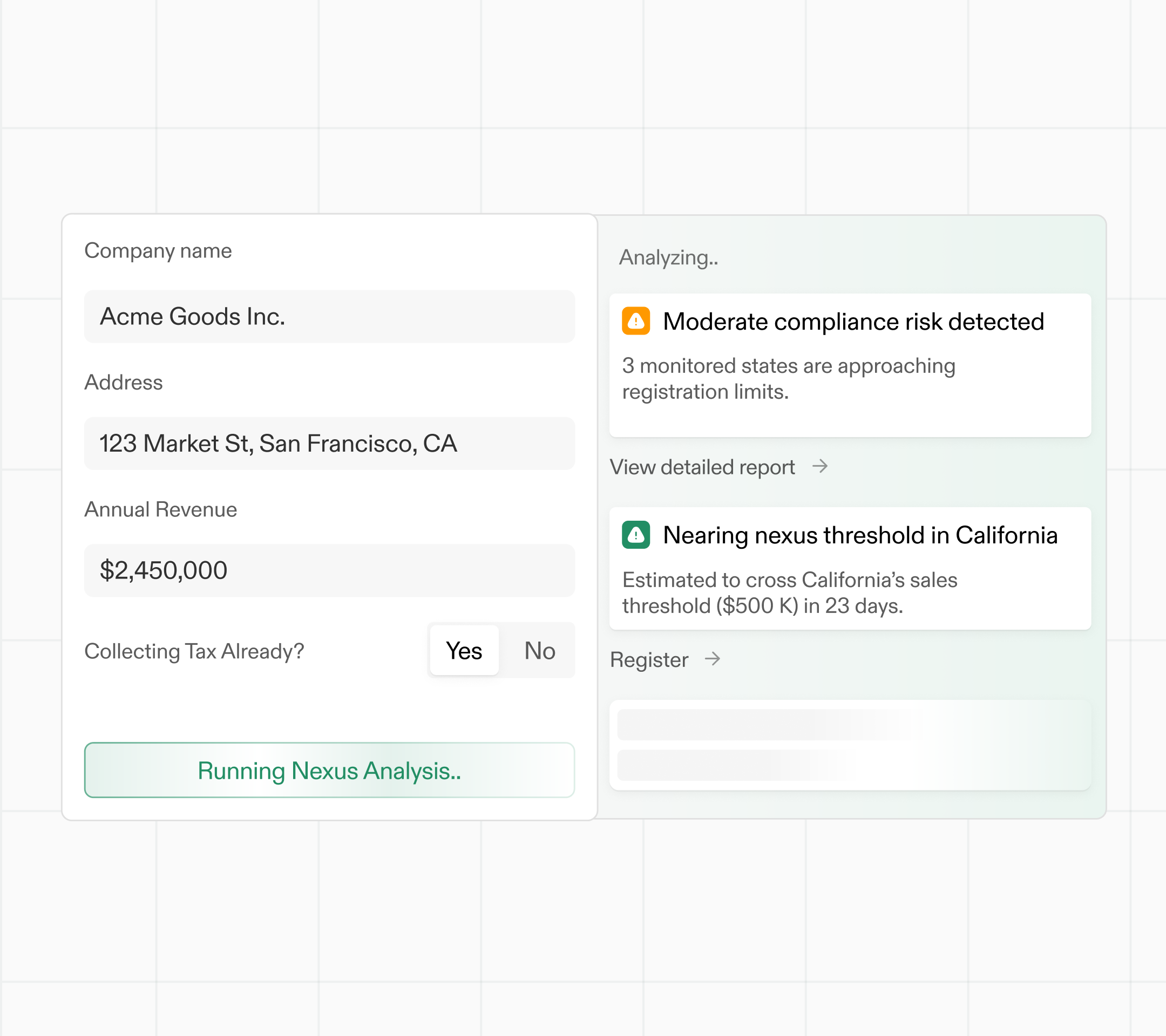

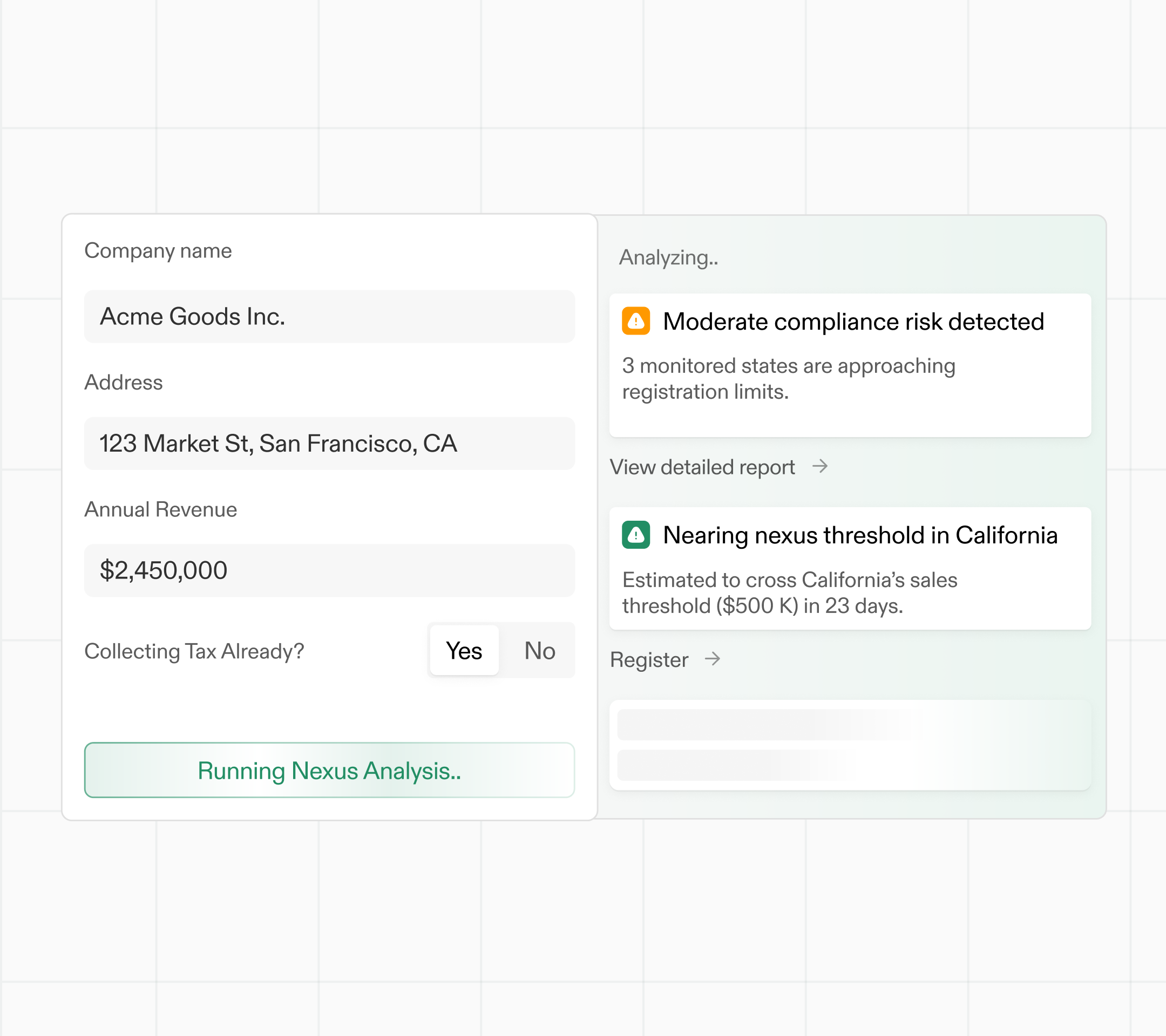

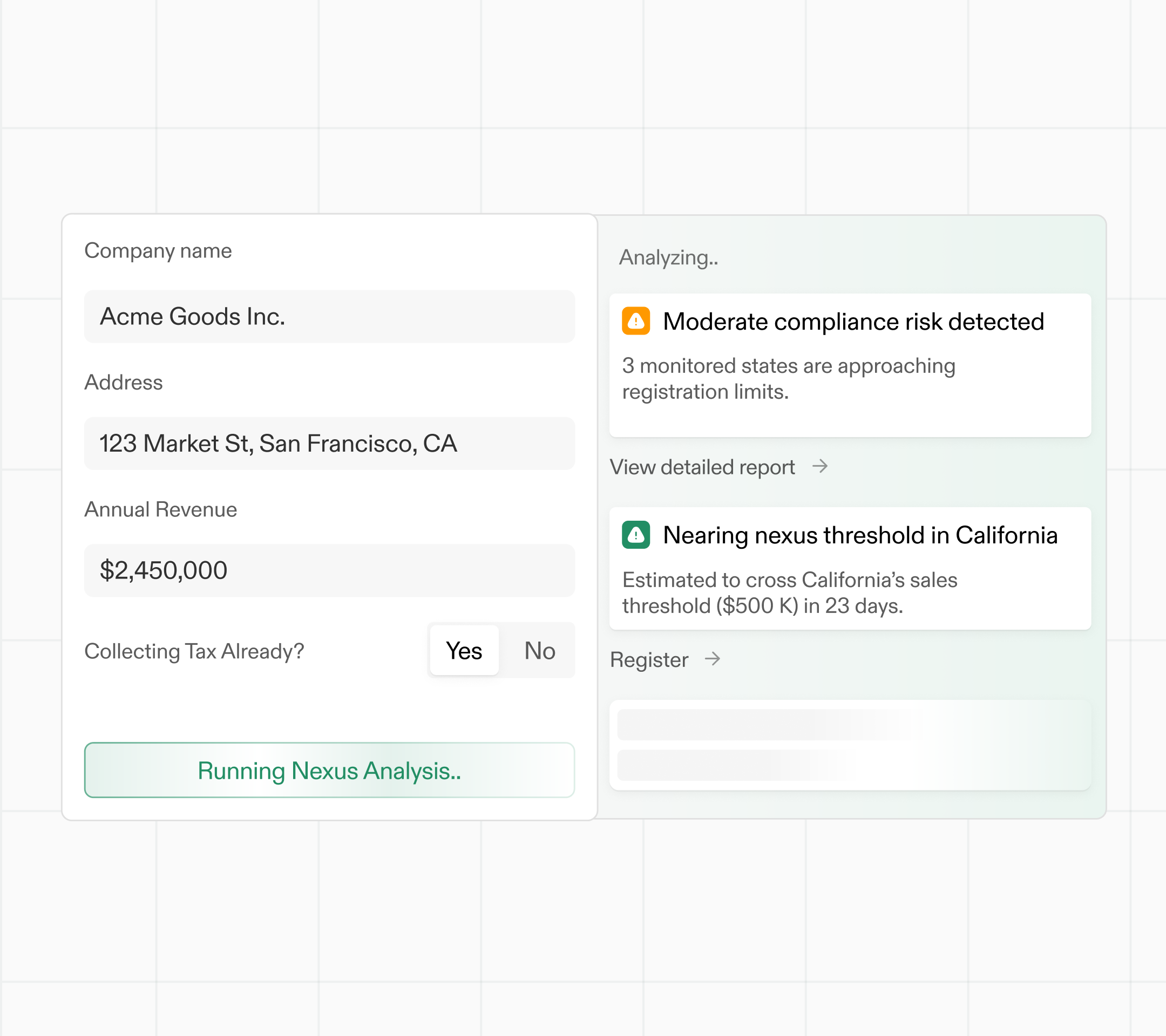

Understand.

Free nexus study, taxability research, and compliance audit in every jurisdiction you have sales, offices, locations, or employees.

Register.

Registrations + back-filings in each state. Future registrations are one click.

Calculate.

Rooftop-accurate across jurisdictions, products, exemptions, and edge cases.

File and pay.

Autofile your monthly and quarterly tax returns in each jurisdiction.

Understand.

Free nexus study, taxability research, and compliance audit in every jurisdiction you have sales, offices, locations, or employees.

Register.

Registrations + back-filings in each state. Future registrations are one click.

Calculate.

Rooftop-accurate across jurisdictions, products, exemptions, and edge cases.

File and pay.

Autofile your monthly and quarterly tax returns in each jurisdiction.

Understand.

Free nexus study, taxability research, and compliance audit in every jurisdiction you have sales, offices, locations, or employees.

Register.

Registrations + back-filings in each state. Future registrations are one click.

Calculate.

Rooftop-accurate across jurisdictions, products, exemptions, and edge cases.

File and pay.

Autofile your monthly and quarterly tax returns in each jurisdiction.

MONITORING & ALERTING

Unified tax notice inbox

Receive a unified virtual inbox of state tax notices and nexus alerts, with automatic triaging, labeling, and expert review.

MONITORING & ALERTING

Unified tax notice inbox

Receive a unified virtual inbox of state tax notices and nexus alerts, with automatic triaging, labeling, and expert review.

MONITORING & ALERTING

Unified tax notice inbox

Receive a unified virtual inbox of state tax notices and nexus alerts, with automatic triaging, labeling, and expert review.

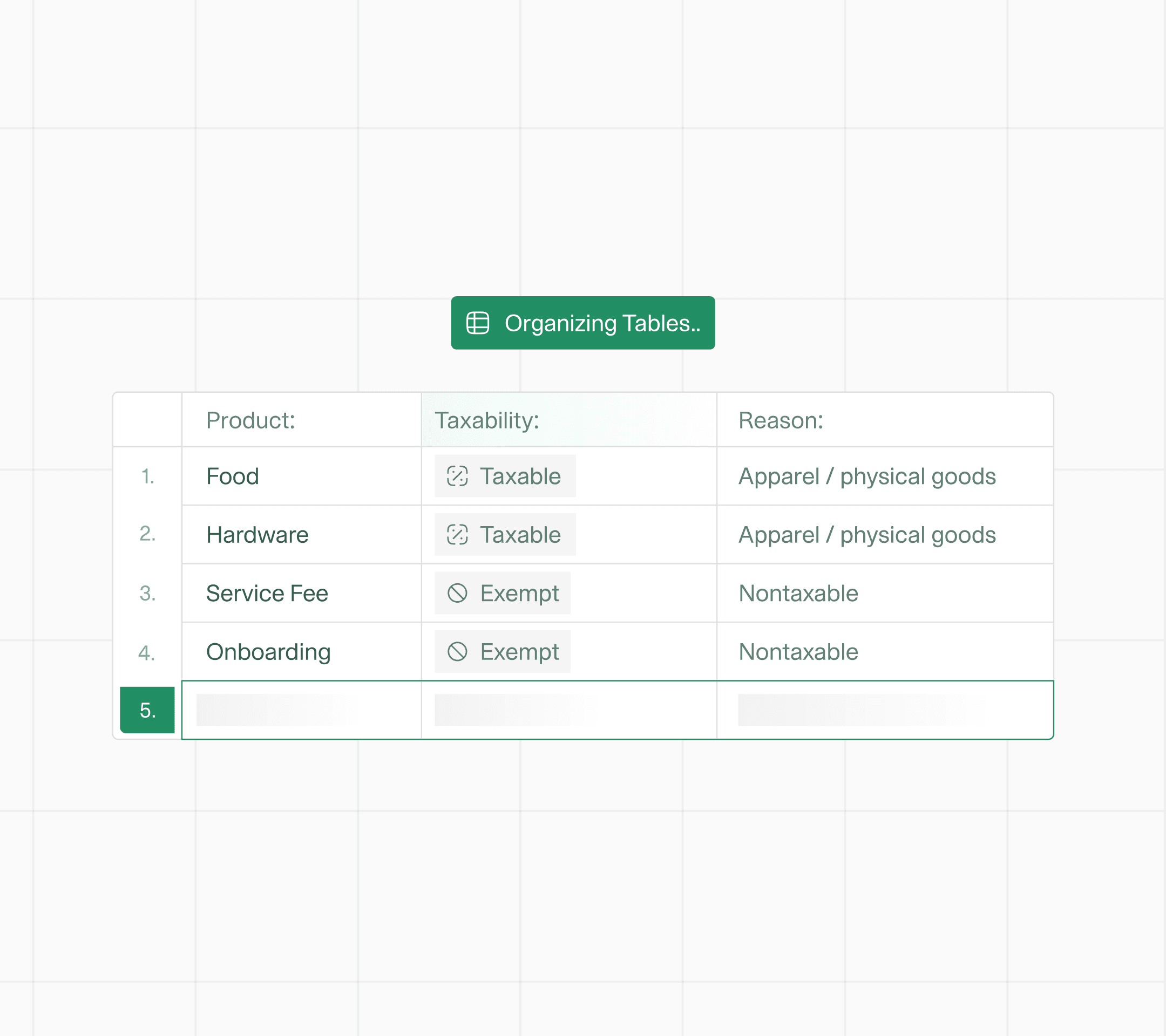

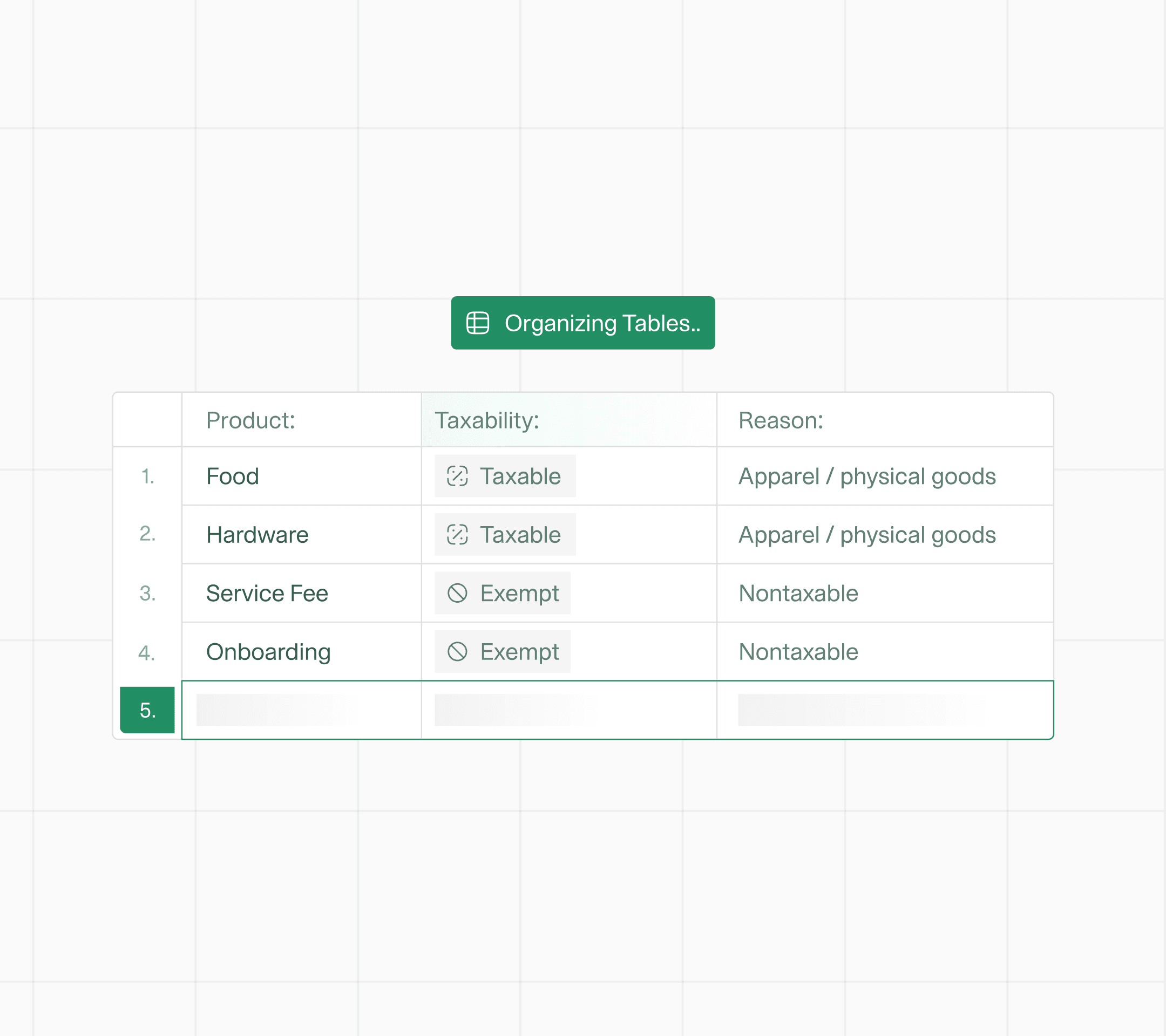

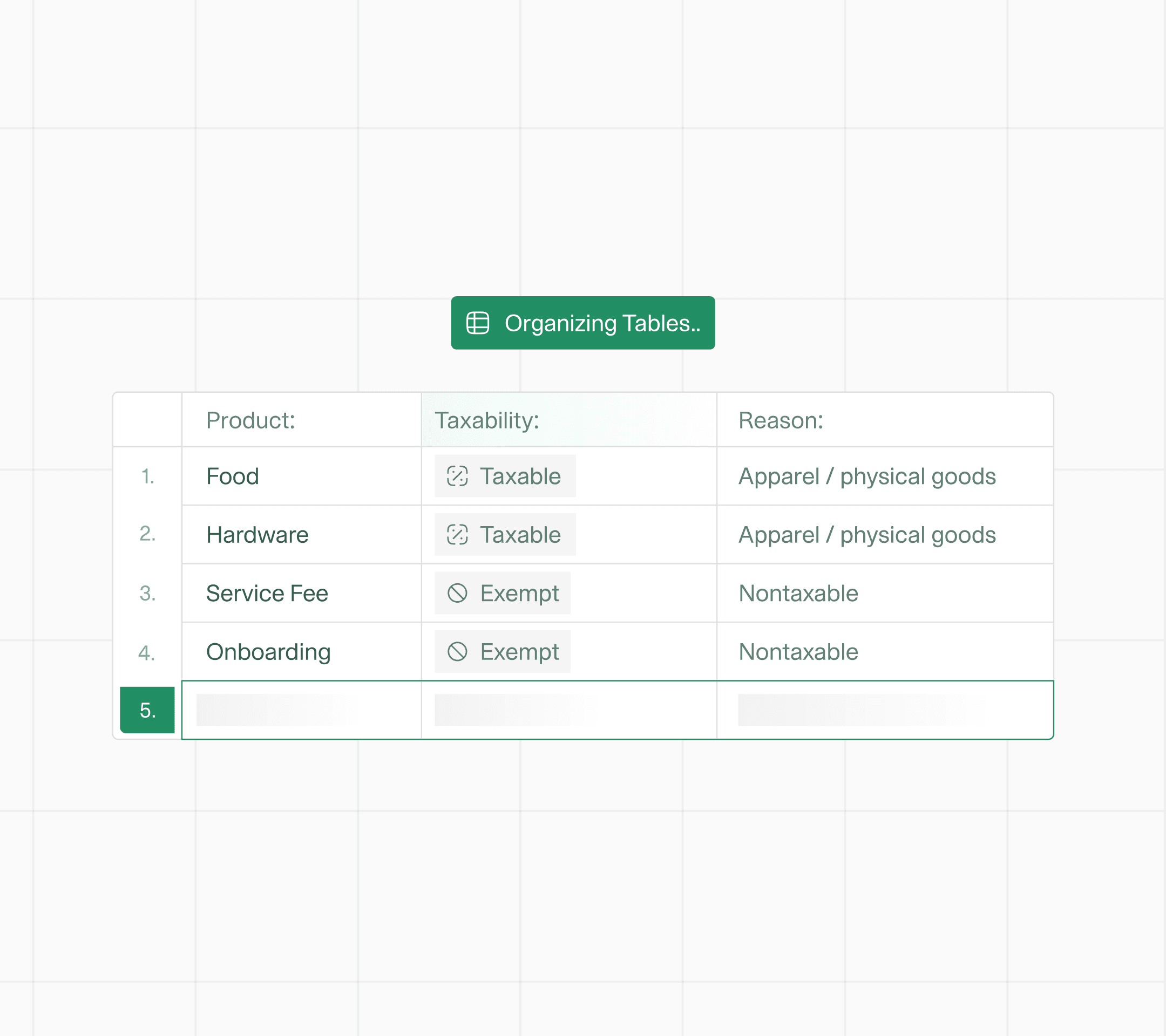

TAXABILITY MAPPING

Assistive product labeling

Automatically map products to the correct tax rules. Taxwire handles taxability, exemptions, and edge cases so every item is coded accurately across all your jurisdictions.

TAXABILITY MAPPING

Assistive product labeling

Automatically map products to the correct tax rules. Taxwire handles taxability, exemptions, and edge cases so every item is coded accurately across all your jurisdictions.

TAXABILITY MAPPING

Assistive product labeling

Automatically map products to the correct tax rules. Taxwire handles taxability, exemptions, and edge cases so every item is coded accurately across all your jurisdictions.

WHY TAXWIRE?

Exemption certificates

Understand your sales tax exposure. Our software + tax experts will help you understand exactly where you have nexus, which jurisdictions tax your products.

WHY TAXWIRE?

Exemption certificates

Understand your sales tax exposure. Our software + tax experts will help you understand exactly where you have nexus, which jurisdictions tax your products.

WHY TAXWIRE?

Exemption certificates

Understand your sales tax exposure. Our software + tax experts will help you understand exactly where you have nexus, which jurisdictions tax your products.

WHY TAXWIRE?

Integrate across your billing, commerce, and accounting stack.

Have a custom billing or commerce setup? Use our API to implement tax calculation.

Billing

Billing

Billing

Calculate real-time, accurate tax rates at invoice - across all billing systems.

Calculate real-time, accurate tax rates at invoice - across all billing systems.

Calculate real-time, accurate tax rates at invoice - across all billing systems.

Commerce

Collect the right sales tax amount at checkout across all products and channels.

Collect the right sales tax amount at checkout across all products and channels.

Collect the right sales tax amount at checkout across all products and channels.

Accounting

Calculate tax natively on invoices in Quickbooks, Xero, Netsuite, and more.

Calculate tax natively on invoices in Quickbooks, Xero, Netsuite, and more.

Calculate tax natively on invoices in Quickbooks, Xero, Netsuite, and more.

TESTIMONIALS

What our customers are saying

"Avalra left us with duplicate filings, missed states, and nearly $200K in overpayments. Taxwire recovered the funds, restored compliance across 20+ jurisdictions, and got everything running smoothly again.”

Avi Arora

COO at Italic

"Avalra left us with duplicate filings, missed states, and nearly $200K in overpayments. Taxwire recovered the funds, restored compliance across 20+ jurisdictions, and got everything running smoothly again.”

Avi Arora

COO at Italic

"Avalra left us with duplicate filings, missed states, and nearly $200K in overpayments. Taxwire recovered the funds, restored compliance across 20+ jurisdictions, and got everything running smoothly again.”

Avi Arora

COO at Italic

“We were growing quickly and needed a sales tax process that could keep up. Taxwire helped us implement a clear, scalable compliance framework from the ground up – giving us the clarity, confidence, and automation we needed as we expand.”

Samantha Palmer

Acc. Manager at Pulley

“We were growing quickly and needed a sales tax process that could keep up. Taxwire helped us implement a clear, scalable compliance framework from the ground up – giving us the clarity, confidence, and automation we needed as we expand.”

Samantha Palmer

Acc. Manager at Pulley

“We were growing quickly and needed a sales tax process that could keep up. Taxwire helped us implement a clear, scalable compliance framework from the ground up – giving us the clarity, confidence, and automation we needed as we expand.”

Samantha Palmer

Acc. Manager at Pulley

“When I discovered Avalara was over-collecting our taxes by 2–3× without approval, I knew we needed real financial controls. With Taxwire, every process is customer-approved and fully transparent. That level of control is non-negotiable for a scaling company.”

Jinal Sanghavi

VP Finance at Levanta

“When I discovered Avalara was over-collecting our taxes by 2–3× without approval, I knew we needed real financial controls. With Taxwire, every process is customer-approved and fully transparent. That level of control is non-negotiable for a scaling company.”

Jinal Sanghavi

VP Finance at Levanta

“When I discovered Avalara was over-collecting our taxes by 2–3× without approval, I knew we needed real financial controls. With Taxwire, every process is customer-approved and fully transparent. That level of control is non-negotiable for a scaling company.”

Jinal Sanghavi

VP Finance at Levanta